All Categories

Featured

Table of Contents

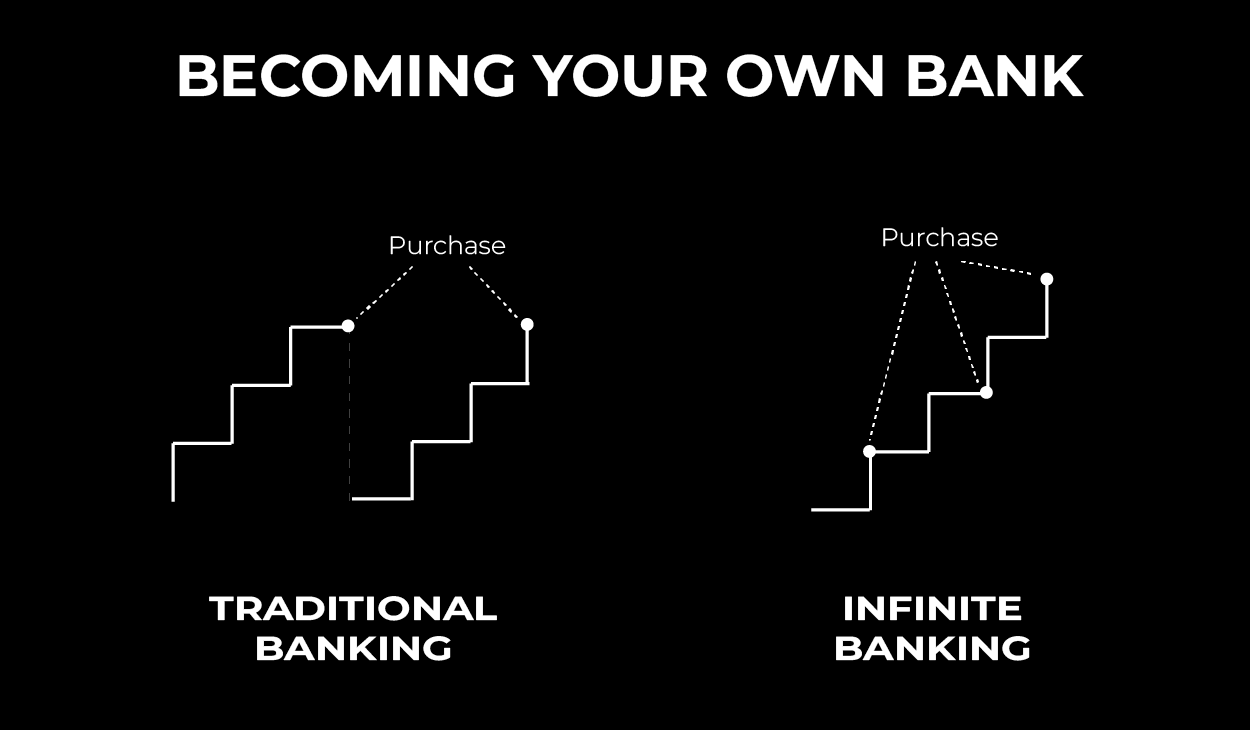

The strategy has its own benefits, but it also has problems with high charges, complexity, and more, leading to it being considered as a rip-off by some. Boundless financial is not the best policy if you need just the financial investment component. The unlimited financial principle revolves around using whole life insurance policies as an economic device.

A PUAR enables you to "overfund" your insurance coverage right as much as line of it ending up being a Customized Endowment Agreement (MEC). When you use a PUAR, you rapidly enhance your money value (and your death benefit), thus raising the power of your "financial institution". Even more, the even more money value you have, the better your rate of interest and returns payments from your insurance provider will be.

With the increase of TikTok as an information-sharing system, monetary suggestions and methods have actually located an unique method of spreading. One such technique that has actually been making the rounds is the boundless financial principle, or IBC for short, amassing endorsements from stars like rap artist Waka Flocka Fire - Infinite Banking wealth strategy. Nevertheless, while the approach is currently popular, its origins map back to the 1980s when economist Nelson Nash presented it to the globe.

How do I optimize my cash flow with Infinite Banking?

Within these plans, the cash value grows based on a price established by the insurance provider. Once a considerable cash value gathers, policyholders can acquire a money value finance. These financings differ from traditional ones, with life insurance policy working as collateral, suggesting one might lose their protection if loaning exceedingly without ample money worth to support the insurance coverage costs.

And while the attraction of these plans appears, there are inherent constraints and dangers, necessitating attentive cash money worth tracking. The method's legitimacy isn't black and white. For high-net-worth people or organization owners, specifically those using techniques like company-owned life insurance policy (COLI), the benefits of tax obligation breaks and substance development might be appealing.

The appeal of boundless banking doesn't negate its challenges: Expense: The foundational demand, a permanent life insurance policy, is more expensive than its term counterparts. Qualification: Not every person receives whole life insurance policy as a result of extensive underwriting procedures that can exclude those with specific health or way of living conditions. Complexity and danger: The complex nature of IBC, coupled with its dangers, may deter numerous, particularly when less complex and less high-risk choices are readily available.

What are the benefits of using Private Banking Strategies for personal financing?

Assigning around 10% of your monthly income to the plan is just not viable for most individuals. Part of what you read below is merely a reiteration of what has actually already been said over.

Prior to you obtain on your own into a circumstance you're not prepared for, know the complying with first: Although the idea is generally offered as such, you're not in fact taking a financing from on your own. If that held true, you would not have to settle it. Rather, you're borrowing from the insurer and need to repay it with passion.

To maximize the benefits of this strategy, it’s essential to consult an experienced broker (what is infinite banking).

A well-designed policy provides tax advantages that enhance long-term financial security.

Unlike traditional loans, Infinite Banking ensures that borrowed funds continue earning interest. Schedule a strategy session with a broker to develop a custom Infinite Banking system.

Some social media articles advise making use of cash money worth from entire life insurance policy to pay down credit rating card financial obligation. When you pay back the funding, a part of that interest goes to the insurance policy firm.

How does Infinite Banking Account Setup create financial independence?

For the initial several years, you'll be settling the payment. This makes it exceptionally challenging for your plan to accumulate worth during this time around. Entire life insurance policy costs 5 to 15 times a lot more than term insurance. A lot of people just can't manage it. Unless you can afford to pay a few to a number of hundred bucks for the next decade or even more, IBC will not function for you.

If you call for life insurance coverage, here are some beneficial pointers to consider: Take into consideration term life insurance policy. Make sure to go shopping around for the finest rate.

How do I track my growth with Privatized Banking System?

Think of never ever having to worry concerning bank finances or high interest prices once more. That's the power of limitless banking life insurance.

There's no collection finance term, and you have the liberty to determine on the settlement schedule, which can be as leisurely as paying back the funding at the time of death. This versatility includes the servicing of the financings, where you can select interest-only payments, keeping the funding equilibrium level and manageable.

Is there a way to automate Infinite Banking For Retirement transactions?

Holding cash in an IUL fixed account being attributed rate of interest can frequently be better than holding the money on deposit at a bank.: You have actually constantly fantasized of opening your very own pastry shop. You can obtain from your IUL policy to cover the preliminary expenditures of renting a room, buying tools, and hiring team.

Individual financings can be acquired from standard financial institutions and credit history unions. Borrowing cash on a credit card is usually really costly with annual portion rates of passion (APR) commonly getting to 20% to 30% or more a year.

Table of Contents

Latest Posts

Profile For Be Your Own Bank

Being Your Own Bank

Profile For Be Your Own Bank

More

Latest Posts

Profile For Be Your Own Bank

Being Your Own Bank

Profile For Be Your Own Bank